An STO explained to a 5 year old

Imagine sitting in a sandpit with your friends. One of your friends wants to build a huge sand castle and needs more sand from friends to be finished faster. This will be the sand castle owner. When using the awesome sand castle later on, friends always have to bring a bit of sand to the sand castle owner in order to use it.

"But this is not fair!" you're saying. Well, when thinking that the sand castle owner is improving the castle for your entertainment and also repairing damaged parts from playing, it becomes fair. Friends who bring the sand castle owner sand to build the sand castle now, will get a portion of sand in return for life from the owner.

What the sand castle owner just did is called fundraising and an STO is a new way to fundraise. Previously, mostly friends with only large amounts of sand were able to help building the castle. Those are the rules by the big folks owning the whole sandpit. Now this is unfair, right?

Also, friends who want to build their own sand castles have to give a large part of their own sand away. That's also a rule by the sandpit owners. This makes it impossible to build sand castles, if you're not owning huge amounts of sand. With an STO, they need to give away less sand than they would usually.

It's only natural that you're now left open with more questions. I will explain them when you're older. Adults, read on.

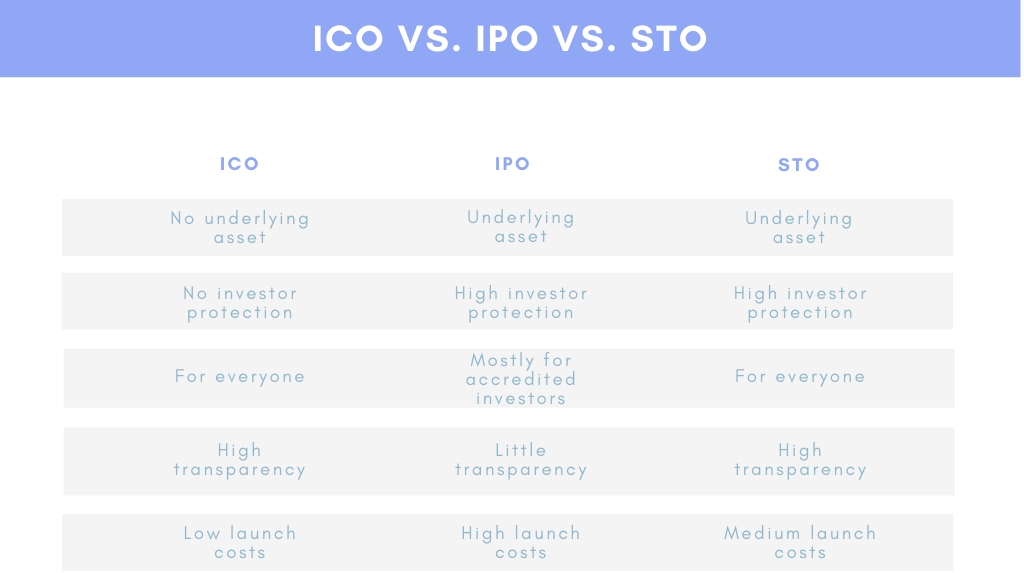

The differences between an ICO, IPO and STO

ICO: Around 2017 the trend of the ICOs(initial coin offerings) emerged. Often times, a whitepaper describing the idea and a website were enough to raise ridiculous amounts of money.

One of the largest ICOs was the one held by Telegram, raising 1.7$ billion. Due to the SEC, the involvement had to be stopped - source. The value of such a token is almost entirely speculative nature, as it isn't tied to any real value like company earnings.

IPO: The common way to raise funds for companies are IPOs(initial public offerings). With an IPO, the company sells shares with corporate rights like dividends or voting. Those shares are considered securities, which are highly regulated. The company issuing the shares has to comply with requirements by regulatory institutions like the US SEC or the German BAFIN.

The process of launching an IPO isn't simple, as it requires time and money. PricewaterhouseCooper states that the IPO assessment can take up to 18 months and in most cases over 1.000.000$ is spent during the process - source. The benefit of an IPO is that it opens the possibility to receive additional capital vs. bank loans or other methods.

STO: The value of an STO has to be tied to an analogue or digital value, similar to the traditional IPO. However, the process is faster and cheaper as clearing houses and banks aren't necessary. Technically, STOs are more similar to ICOs. When it comes to trust, it's more similar to an IPO.

Below, some key points are comparatively illustrated.

How an STO is realized via the blockchain

An STO, just like an ICO, is created with a smart contract on a network like Ethereum. In short, with a smart contract it's possible to do what a usual contract can do. All without the need for a middle man, like a lawyer. Fully digital.

Ethereum is the most popular smart contract platform and most development activity takes place there.

The key reason why a lot of new fintech applications are built on platforms like Ethereum is, because smart contracts are a lot more efficient than usual contracts.

Example contract: Joe and Alice want to make a personalized bet on the weather tomorrow. Usually, a lawyer is required to make the bet, the contract, legally verified. Joe and Alice are smart and want the bet to be secure but also cheap. They choose the smart contract platform Ethereum. Their smart contract calls a weather API and if Joe was right, he'd get the money sent automatically. Else, Alice gets the money.

Example with an STO: Not only bets can happen, but also so called ERC-20 tokens can be issued. This makes it possible for ICOs and STOs to exist. The programming logic behind an STO is usually pretty simple. In the case of a real estate STO, the smart contract would need to issue ERC-20 tokens when someone buys them and additionally provide percentage based monthly rent payments to the addresses holding the tokens. The rent payments could be done in Ethereum, which is a cryptocurrency itself. There are also options to provide fiat-pegged cryptocurrency called stablecoins. This should be the preferred way, as security token owners don't necessary want to be exposed to the volatility of Ethereum.

The owner of the real estate object buys Ethereum with the rent at the end of the month and simply sends it to the smart contract address. The smart contract automatically distributes the rent among the token holders. The owner could even set an automated payment to buy Ethereum and automate the sending to the contract address. With that, the whole process would be completely automated.

Security risks of security token (offerings)

"Not your keys, not your coins": The popular expression in the cryptocurrency world also holds true for security tokens. Security tokens are accessed by using the private key associated with the public key (the cryptocurrency address) - Want to know more about it?

Security token offerings are typically done via centralized services. Those services handle all of the occurring transactions. This means that they hold all the private keys associated with the public keys of their customers. If a service hack happens, your investment could be gone unfortunately. Takeaway message: Store your security token information on your own device!

Trust: You wouldn't worry a lot about the security of buying stocks via your bank. But you should worry about buying security tokens via a new service. As this trend is emerging, there aren't many well-established services that gained a reputation over the past years - Simply because it's a young industry.

It's healthy and needed to research those services on your own. As the years go by, people can hopefully rely on a couple trustworthy services. In the meantime, you are your own security risk!

Malware: While saving the security token information on your device protects you from service hacks, it doesn't protect you from malware. Due to the rise of popularity in cryptocurrencies, specific malware got developed.

Examples are wallet stealer, which send your information directly to the attacker or malware that replaces the address in the clipboard with a fraudulent one.

Brief history of STOs

In 2018, STOs began to make their first baby-steps. Lots of STO issuers had a small investor base, high starting costs and the infrastructure wasn't really there yet. GBX is one of those platforms. For example, they announced to offer digital debt securities and funds - source. There have been no further blog posts since the 10.15.2019.

2019 was marked by the crypto-friendly Satander bank, which issued a 20$M tokenized bond on the Ethereum network - source. In september, Allinfra announced a collaboration with Link REIT to work on the tokenization of assets - source. In this year it became clear, that bigger institutions recognize the use-cases of STOs and want to participate in the still young market.

In 2020, the place to be for issuing STOs and blockchain companies in general got obvious. High starting costs were reduced over the months/years. The infrastructure has been built. Now, it seems to only be a matter of issuing the right security tokens to attract investors in order for the trend to really come to light.

Examples of successful STOs

One of the more popular STOs is Nexo. The platform offers instant loans with competitive rates. It successfully raised 52.5$ million during the token sale. The majority of Nexo shareholders are also majority shareholders of Credissimo. The fintech group operates for years, which gives Nexo more credibility.

tZERO is another one. The platform became the first regulated security token exchange in the US. They raised 134$ million during the token sale. It was originally founded by the CEO of Overstock, which also gives the project a lot credibility.

More recently, a real estate object in Lüneburg, Germany was tokenized and successfully sold for 1.5$ million - source.

Favourable jurisdiction

Many jurisdictions like the EU and the US have regulated STOs - source. While Switzerland still is one of the more liberal places for STOs to be hosted, Liechtenstein got more attention this year.

With the signed "Blockchain Act", Liechtenstein is the first country in the world to define a legal framework surrounding the blockchain technology. This is needed, because there will be fundamental questions over and over again. The framework makes it easier to decide on basic questions, improving the development of companies.

On another note, Liechtenstein is member of the EEA. This makes it possible to target the whole European market more easily. Companies involving STOs in Liechtenstein can therefor be expected to lead the industry.

Conclusion

As STOs share similar features of ICOs, people may be overly sceptical about them. Hence, STOs have to distance themselves from the shady past of ICOs. As outlined, users will have to inform themselves about the security of their private keys and/or the security of the used service.

On the flipside, seeing more companies dipping their toes into this area is a positive sign for the trend continue to emerge. We're seeing the new possibility of tokens created by individuals or companies that so far hadn't been able to pay high launch costs of an IPO. If investors are willing to participate in those is a question to which the answer is found in the coming months. Of course, a faster launch process and reduced costs benefit bigger players as well.